Financial planning and analysis (FP&A) software has become a cornerstone for organizations looking to streamline budgeting, forecasting, and reporting. As the digital landscape evolves, businesses of all sizes are adopting tools to replace outdated methods and gain deeper financial insights. In 2025, the financial planning & analysis software market is more diverse than ever, catering to different needs based on business size and complexity.

Evolution of FP&A Software

- On-Premise Solutions: Historically, FP&A relied on on-premise software like Oracle Hyperion, which required substantial IT infrastructure and resources. These systems were often complex and costly, making them accessible primarily to large enterprises.

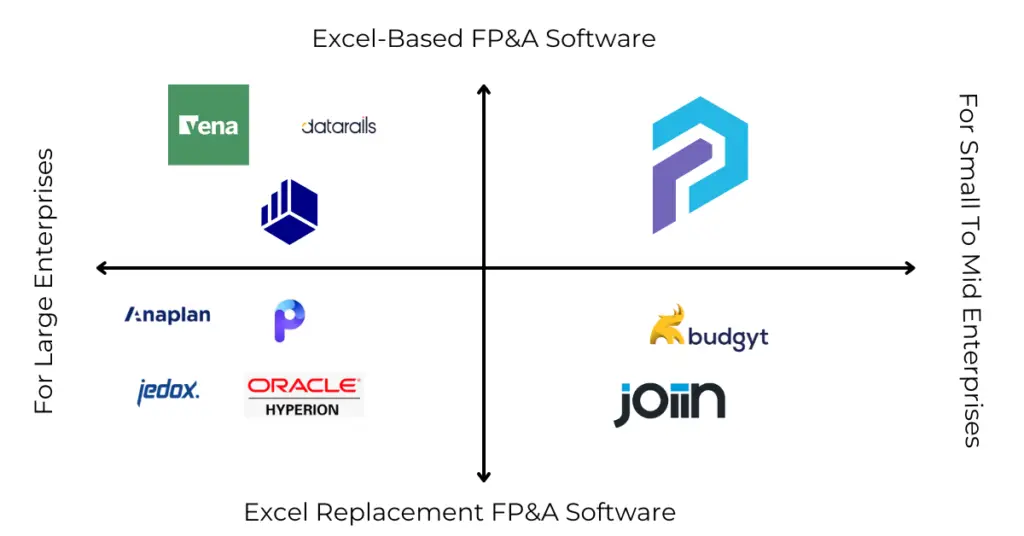

- Transition to Cloud-Based Platforms: The advent of cloud computing revolutionized FP&A by offering scalable, cost-effective, and accessible solutions. Cloud-based FP&A tools can be broadly categorized into:

- Excel-Replacement Tools: These platforms aim to replace traditional spreadsheets by providing multi-dimensional data modeling within their own interfaces.

- Excel-Based Tools: These solutions integrate seamlessly with Excel, enhancing its capabilities while allowing users to continue using a familiar interface.

FP&A Software Categories and Market Segments

Enterprise-Level Solutions:

Enterprise solutions are designed for large enterprises that require multi-level sales teams and detailed sales processes. These tools offer robust modeling capabilities, real-time collaboration, and scalability to handle complex financial scenarios.

SMB-Mid-Market Focused Solutions:

SMB solutions cater to small businesses looking for easy-to-use, self-serve options with the flexibility of an optional setup process. These tools typically integrate with familiar environments, ensuring ease of use and quick adoption. They provide dynamic financial planning and forecasting capabilities, featuring user-friendly interfaces and pre-built integrations to make them accessible for smaller teams.

Mid-Market to Enterprise Transition Solutions:

Mid-tier to enterprise solutions are aimed at companies that prefer a detailed purchasing process coupled with a structured setup. These platforms have evolved to cater to larger enterprises, reflecting an increasing demand for scalable FP&A solutions with enterprise-grade features.

Here are the five best financial planning & analysis software tools to consider in 2025:

1. PivotXL

Best for: Small to medium-sized businesses and enterprises seeking an Excel-based approach with powerful enhancements.

PivotXL stands out as a leader in financial planning & analysis software due to its unique approach of leveraging Excel, a tool already familiar to most finance professionals. Instead of replacing Excel, PivotXL enhances it, allowing users to retain the flexibility they love while integrating advanced features such as automated data consolidation, real-time collaboration, and robust reporting dashboards.

Why choose PivotXL?

- Excel-based foundation: Familiar interface that eliminates the need for steep learning curves.

- Cost-effective: Designed with small to medium-sized businesses in mind but scalable for enterprises.

- Cloud integration: Real-time updates and secure cloud storage make it ideal for remote teams.

- Customization: Tailor reports and workflows to fit unique business needs.

If you’re looking for an FP&A solution that bridges the gap between traditional spreadsheets and sophisticated financial software, PivotXL is the perfect choice.

✅ Check out our product demos – See PivotXL in action with real finance workflows.

📘 Explore our product documentation – Step-by-step guides to help you get started.

🚀 Want to try the product? Sign up now — no credit card needed!

2. Jirav

Best for: Small to medium-sized businesses looking for dynamic financial planning and forecasting.

Jirav is a cloud-based financial planning & analysis software that helps businesses streamline their budgeting, forecasting, and reporting processes. Its user-friendly interface and pre-built integrations make it an attractive option for teams seeking quick adoption.

Key features:

- Drive based budgeting.

- Integrations with accounting systems like QuickBooks and NetSuite.

- Easy-to-use dashboards for visualizing financial performance.

Jirav’s emphasis on simplicity and efficiency makes it an excellent choice for small to medium-sized businesses seeking robust financial planning capabilities.

3. Anaplan

Best for: Large enterprises with complex planning and modeling needs.

Anaplan offers a comprehensive platform for connected planning, making it ideal for enterprises managing extensive datasets and multiple departments. Its robust modeling capabilities and scalability set it apart.

Key features:

- Real-time collaboration across departments.

- Advanced modeling for complex financial scenarios.

- Integrations with a wide array of business systems.

While Anaplan is highly powerful, it’s best suited for enterprises with the resources to handle its complexity and cost.

4. Adaptive Insights (Workday Adaptive Planning)

Best for: Medium to large organizations seeking a balance between usability and advanced functionality.

Adaptive Insights is known for its intuitive interface and strong integration with Workday’s ecosystem. It’s particularly effective for workforce planning and integrating HR and financial data.

Key features:

- Workforce and financial planning in a single platform.

- User-friendly dashboards and reporting.

- AI-driven insights for more accurate forecasting.

It’s an excellent choice for businesses already using Workday or those looking for a scalable mid-tier solution.

5. Planful

Best for: Growing businesses that need robust FP&A tools without enterprise-level complexity.

Planful focuses on simplifying the financial planning process for mid-sized businesses. Its pre-built templates and intuitive workflows make it accessible for teams with varying levels of technical expertise.

Key features:

- Pre-built planning templates.

- Centralized data management.

- Strong reporting and visualization tools.

Planful’s ease of use and cost-effectiveness make it a great choice for growing companies.

Understanding the Financial Planning & Analysis Software Landscape

The financial planning & analysis software market in 2025 caters to a wide spectrum of needs. On one end, there are Excel-based tools like PivotXL that offer familiarity and accessibility for small to medium-sized businesses. These tools enhance the capabilities of Excel, making it a viable solution for those who aren’t ready to adopt complex platforms. On the other end, enterprise-focused software like Anaplan and Adaptive Insights provides advanced features for larger organizations with complex requirements.

Choosing the right financial planning & analysis software depends on your business size, budget, and specific needs. For businesses seeking flexibility without sacrificing power, PivotXL is the top recommendation in 2025. Its unique approach of enhancing Excel ensures you’re not just keeping up with the times but also gaining a competitive edge.