A budget isn’t just a spreadsheet of numbers — it represents the tactical execution of an Annual Operating Plan (AOP). While the AOP lays out the overall strategy, the budgeting process translates those high‑level goals into actionable financial plans. Through this process, companies define revenue targets, allocate resources to departments, and establish guardrails for spending. As a result, the budget becomes the bridge between vision and day‑to‑day execution, turning strategy into measurable outcomes.

📌 Related read: Annual Operating Plan vs. Budget: What’s the Difference?

What Is the Budgeting Process for Businesses?

The budgeting process is the structured method organizations use to:

- Plan and set financial goals

- Collect inputs from different departments

- Consolidate, review, and approve the numbers

- Monitor budget vs. actuals and adjust as needed

In reality, this “structured method” often turns into a chaotic manual grind when it’s run in Excel and email.

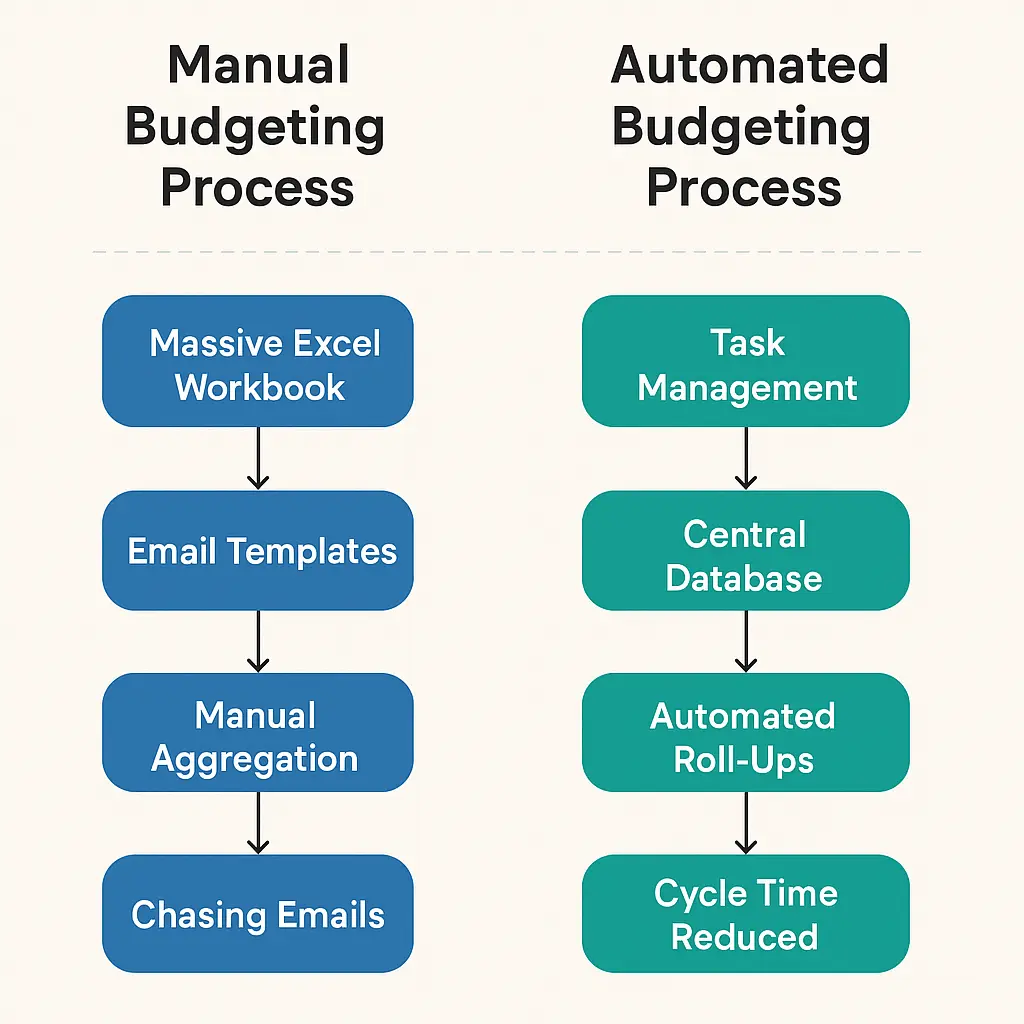

How the Budgeting Process Is Run in Excel (Manual Methods)

For most businesses, the budgeting process in Excel happens in one of two ways:

📘 Related Read:

👉 Step-by-Step Guide to Building a Budget in Excel

1️⃣ The “Franken-Excel” Approach

- Finance builds one massive Excel workbook with dozens of tabs linked together.

- This single file is shared across the organization.

- As department heads input their numbers, the linked cells auto-update to a master sheet.

🚨 Problems with this manual budgeting process:

- Data security risks: Everyone touches the same sensitive file.

- File fragility: A renamed sheet or broken link can bring the whole thing down.

- Version chaos: Multiple copies (“Budget_v5_FINAL_REALLY_FINAL.xlsx”) make it impossible to know which one’s right.

2️⃣ The Template & Email Approach

- Finance creates department-level Excel templates, pre-populated with actuals to date.

- Templates are emailed to department heads.

- Completed templates are manually aggregated back into the master model.

🚨 Problems with this budgeting process format:

- Labor intensive: Hours or days wasted copy‑pasting data.

- Error‑prone: Overwritten formulas, wrong file versions, and missing email attachments.

- No tracking: Endless email chases — no clear view of who’s submitted or reviewed what.

The Core Issue: No Tracking, No Control

Even if the math works in Excel, the process doesn’t scale.

- ❌ No task management: Finance can’t see who’s done what or when.

- ❌ No audit trail: No record of who changed which numbers.

- ❌ No version discipline: Files are scattered across inboxes, SharePoint folders, and desktops.

Result? The budgeting process becomes a month‑long slog every year.

Automating the Budgeting Process in Excel

The answer isn’t abandoning Excel. It’s connecting Excel to a smarter system so the budgeting process becomes structured and automated.

✅ Task Management

- Assign budgeting tasks to each department head with deadlines.

- Track completion without chasing emails.

✅ Central Database

- Data isn’t “stuck” in the spreadsheet.

- Department heads enter their numbers in Excel and send them to the database via an add‑in.

✅ Automated Roll‑Ups

- Once submitted, numbers auto‑roll up into a live budget P&L — no manual aggregation.

What an Automated Budgeting Process Looks Like

✅ Cycle time is cut by 50%.

✅ No more “Franken‑Excel.”

✅ No more chasing templates in inboxes.

1️⃣ Finance sends out tasks (e.g., “Submit your Q1 budget by Friday”).

2️⃣ Department heads open their Excel template through the add‑in.

3️⃣ They fill in the numbers and click “Send Data.”

4️⃣ The data flows into a central database.

5️⃣ Finance sees instant roll‑ups — no broken links, no manual consolidation.

Why Excel Still Matters in the Budgeting Process

Even in 2025, Excel remains the default tool for FP&A.

- Familiarity: Every finance pro knows it.

- Flexibility: Build any model, any scenario.

- Speed: Nothing’s faster for quick what‑ifs.

But Excel alone can’t handle the entire budgeting process for a modern organization. The future is Excel + automation — keeping Excel for modeling, but connecting it to systems for data security, task tracking, and live consolidation.

Conclusion: Streamline the Budgeting Process Without Losing Excel

Most companies don’t need to abandon Excel.

They need to stop abusing it.

By adding:

- ✅ Task Management (assign & track)

- ✅ Central Database (secure storage)

- ✅ Automated Roll‑Ups (instant consolidation)

…you can transform your budgeting process from a manual slog to an automated, auditable workflow — without losing the spreadsheet power you rely on.