Introduction: Why Financial Reporting Software for Professional Services Matters

Reporting software for professional services helps CFOs at $50M–$500M firms automate financial workflows, improve profitability, and scale Excel models efficiently. Success depends on billable hours, resource utilization, partner compensation, and revenue recognition.

Relying solely on spreadsheets creates chaos, delays, and risk. Financial reporting software for professional services is no longer optional — it provides the automation, visibility, and analytical power CFOs need to make strategic, informed decisions while scaling the firm efficiently.

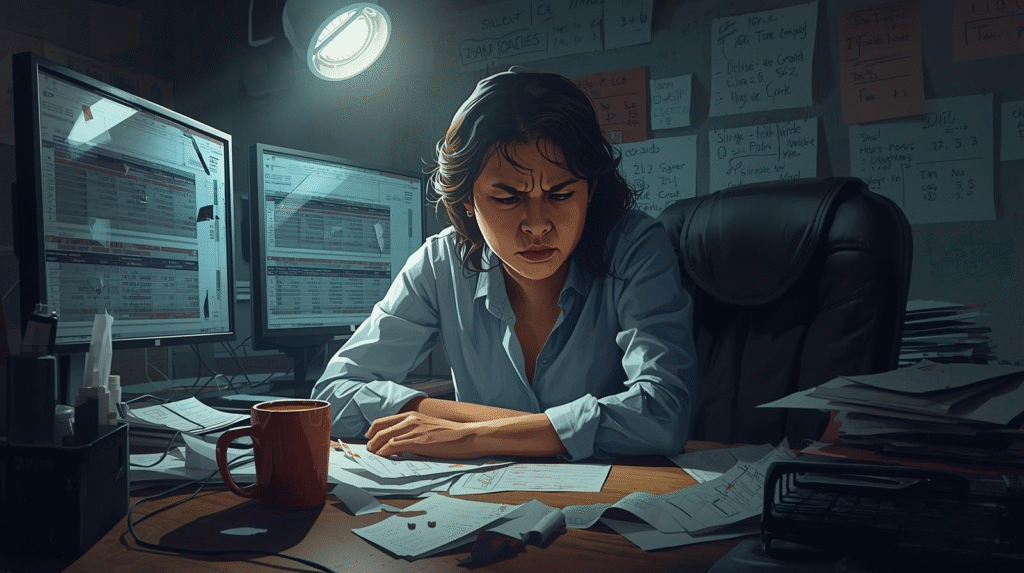

Challenges CFOs Face Without Financial Reporting Software for Professional Services

Even today, many firms run their finance operations on Excel. While familiar and flexible, spreadsheets fail when firms grow.

Engagement Sprawl and Manual Consolidation

Each project, client, or practice area often maintains its own workbook. Consolidating dozens — or hundreds — of files requires endless copy-pasting, manual reconciliation, and introduces errors.

Broken Links and Fragile Models

A single formula change or file rename can break complex utilization or billing models, leaving finance teams scrambling to fix errors before reporting deadlines.

Version Chaos

Partners and project managers frequently send multiple “final” spreadsheets, each with conflicting numbers. Finance must decide which version is correct, wasting time and creating risk.

Lack of Real-Time Insights

By the time numbers are consolidated, insights may already be outdated, preventing timely decisions on staffing, client assignments, or profitability strategies.

How Financial Reporting Software for Professional Services Transforms Finance

Modern FP&A tools provide a structured, centralized, and automated financial environment. CFOs can finally replace manual workflows with scalable processes.

Centralized Data Management

All client, project, and practice area financials feed into one system of record, creating a single source of truth for financial planning and analysis.

Automated Consolidations and Scenario Planning

Firm-wide P&Ls, dashboards, and forecasts update automatically. CFOs can run “what-if” scenarios to test:

- What if utilization drops 5%?

- What if billing rates increase 10%?

- How will opening a new office affect margins?

Revenue Recognition Automation

FP&A software automates GAAP-compliant recognition for milestone-based, fixed-fee, or time-and-materials contracts — eliminating manual errors and speeding reporting.

Visibility Into Utilization and Profitability

Dynamic dashboards allow CFOs, finance teams, and partners to see which clients, projects, or teams are profitable, and which drain resources.

PivotXL: The Preferred Financial Reporting Software for Professional Services

Many FP&A platforms force teams to abandon Excel. PivotXL takes a different approach — it keeps Excel at the center while scaling it for growth and automation.

Deep Excel Integration

Keep existing Excel models, formulas, and pivot tables, but refresh data instantly from a central database.

Central Database and Custom Scripting

Store all engagement, project, and client data in one structured environment. Automate complex calculations like partner compensation, allocations, and revenue recognition.

Back-Office Analyst Support

Extend your finance team with expert analysts who manage mappings, scripts, and template maintenance.

Why Financial Reporting Software Matters More in Professional Services Than Other Industries

Unlike product businesses, professional services sell time and expertise. Finance must manage:

- Utilization and Billable Hours: Every percentage point affects revenue directly.

- Revenue Recognition Complexity: Contracts often span months or years.

- Partner Compensation: Tie compensation to profitability without political conflicts.

- Resource Planning: Assigning the right people to the right projects has financial and operational consequences.

Real-World Examples

$200M Consulting Firm

Before PivotXL:

- Three weeks to consolidate engagement and partner comp spreadsheets

- Delays in reporting and partner disputes

After PivotXL:

- Real-time reporting of engagement profitability

- Dashboards available instantly

- Hundreds of hours saved per quarter

$75M IT Services Firm

Before PivotXL:

- 150+ linked Excel workbooks

- Outdated utilization data and revenue recognition errors

After PivotXL:

- Centralized engagement data

- Automated revenue recognition

- Close cycle reduced from 10 to 3 days

- Partner comp disputes dropped 80%

Key Features CFOs Should Look for in Financial Reporting Software for Professional Services

- Excel Integration — Keep existing models intact

- Automated Revenue Recognition — Handle milestone, fixed-fee, or hourly contracts

- Engagement-Level P&Ls — Drill down to client, project, or team

- Scenario Planning — Model utilization, rate, or headcount changes

- Partner Compensation Modeling — Automate complex calculations

- Collaboration & Version Control — Ensure everyone works from the same numbers

- Scalability — Grow from $50M to $500M revenue without breaking workflows

Bottom Line: How Financial Reporting Software for Professional Services Helps CFOs Drive Growth

FP&A software for professional services is not about replacing Excel — it’s about making Excel work at scale.

PivotXL Provides:

- Central database for every engagement

- Deep Excel integration to preserve existing workflows

- Custom scripting for complex rules

- Analyst support for lean finance teams

Results for CFOs:

- Faster closes

- Sharper forecasts

- Cleaner engagement reporting

- More time for strategic leadership

FAQs on Financial Reporting Software for Professional Services

Q1: What is financial reporting software for professional services?

A1: It automates engagement profitability, revenue recognition, partner compensation, and resource utilization for firms $50M–$500M.

Q2: Why not just use Excel?

A2: Excel is flexible but doesn’t scale. Manual roll-ups and broken links delay reporting and introduce risk.

Q3: How does FP&A software improve profitability?

A3: It provides real-time visibility into utilization, billing, and engagement profitability, enabling better financial decisions.

Q4: Does FP&A software replace Excel?

A4: No. Tools like PivotXL enhance Excel, keeping familiar workflows intact while scaling and automating tasks.

Q5: Who benefits most?

A5: CFOs, finance teams, partners, and firm leadership — faster closes, cleaner data, sharper insights.

Ready to Transform Your Financial Reporting?

See how PivotXL’s financial reporting software for professional services can streamline your reporting, automate consolidations, and boost profitability.

- Experience real-time insights: Centralize all engagement and project data in one system.

- Keep Excel workflows: Maintain familiar templates with live integration.

- Automate complex tasks: Revenue recognition, partner compensation, and scenario planning made simple.

Take the first step toward smarter FP&A and unlock the full potential of your finance team.

Releted Topic: FP&A Software for Professional Services: The CFO’s Guide to Profitability and Growth