📘 This post is part of the ebook: Automating Financial Planning, Reporting & Analysis in Excel

Read the full Table of Contents: Automating Financial Planning, Reporting & Analysis in Excel

⬅️ Previous Chapter: Chapter 6: Automating Financial Analysis in Excel

➡️ Next Chapter: Chapter 8: Automating Forecasting and Scenario Planning

Introduction

Automating the Month-End Close is one of the most effective ways for finance teams to save time, improve accuracy, and reduce stress. This process marks the moment when transactions turn into truth — where every account is reconciled, verified, and finalized for reporting.

However, many teams still depend on manual spreadsheets, endless emails, and inconsistent checklists. By automating the month-end close, finance teams replace chaos with clarity. As a result, they can close books faster, enhance accuracy, and shift their focus from manual work to meaningful financial analysis.

In this article, we’ll explore how automating the month-end close transforms a hectic process into a reliable, structured workflow that runs like clockwork every month.

Why the Month-End Close Matters

The month-end close bridges the gap between daily transactions and accurate reporting. Its primary goal is to confirm that every account is reconciled and complete. Yet, manual processes often lead to delays, confusion, and stress across teams.

By implementing automation, organizations gain a structured, transparent, and auditable workflow that operates efficiently and predictably every month. Therefore, automation becomes not just a convenience — but a necessity for modern finance.

The Month-End Close Process

Every close follows a predictable pattern:

- Gather data

- Reconcile accounts

- Review exceptions

- Generate reports

- Finalize and publish

When these steps are standardized and consistent, they can easily be automated. Moreover, automation ensures that every task is completed on time, assigned to the right person, and documented for compliance.

The Two Parts of the Month-End Close

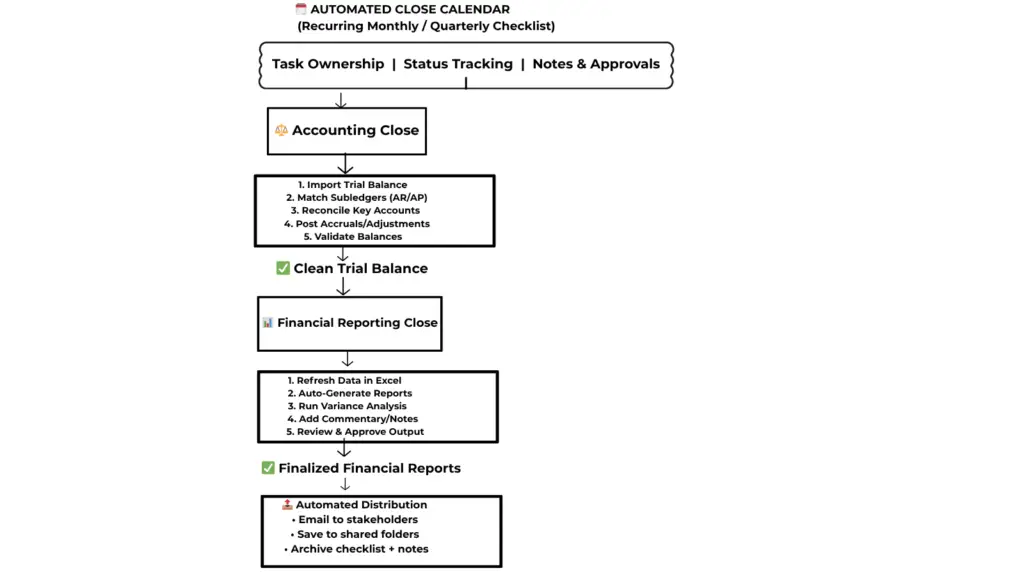

1. Accounting Close

The accounting close focuses on data accuracy and validation.

Teams:

- Match the trial balance with subledgers (Accounts Receivable, Accounts Payable, Payroll, etc.).

- Post adjusting entries such as accruals, depreciation, and reclassifications.

- Review and clear suspense accounts.

Goal: Deliver a clean, accurate, and complete trial balance ready for reporting.

2. Financial Reporting Close

Once accounting data is verified, automation flows seamlessly into reporting.

- The trial balance automatically updates P&L, Balance Sheet, and Cash Flow reports.

- Variance and KPI dashboards refresh in real time.

- Reports are reviewed, annotated, and shared with management.

Goal: Provide complete, consistent, and ready-to-share reports without delay.

Designing a Streamlined Close

A successful automated close depends on structure, visibility, and accountability. Below is a framework for an automated close cycle:

| Stage | Description | Owner | Automation Example |

|---|---|---|---|

| Checklist Setup | Define recurring tasks and due dates | Controller | Automated recurring templates |

| Data Import | Pull trial balance and subledgers | Accounting | Auto-refresh from ERP |

| Reconciliation | Validate balances and flag variances | Accounting | Rules-based exception reports |

| Adjustments | Record accruals, depreciation, etc. | Accounting | Journal upload templates |

| Report Generation | Update reports automatically | FP&A | One-click refresh |

| Review & Approval | Approve and finalize reports | CFO/Controller | Preparer–approver workflow |

| Distribution | Publish management pack | FP&A | Automated email/folder sync |

The Power of an Automated Checklist

An automated month-end close checklist ensures that:

- Every step is documented, timestamped, and assigned.

- Dependencies are clearly mapped.

- Comments and attachments remain in one place.

- The checklist resets automatically each month.

Example recurring tasks:

✅ Reconcile AR/AP subledgers to GL

✅ Post depreciation entries

✅ Review expense accruals

✅ Refresh trial balance in the reporting template

✅ Review variance comments

✅ Finalize and archive reports

As a result, teams eliminate guesswork and gain real-time visibility into progress and bottlenecks.

Integrating Accounting and Reporting Close

Both parts of the close share the same structure:

Data → Validation → Approval → Output

- In the Accounting Close, the output is a clean trial balance.

- In the Reporting Close, the output is finalized financial statements.

With automation, both workflows can run in parallel and finish within a single day — ensuring speed without sacrificing accuracy.

Key Benefits of Automating the Month-End Close

| Benefit | Description |

|---|---|

| Speed | Reduce month-end close cycle from days to hours. |

| Transparency | Track progress in real-time. |

| Accountability | Clear preparer–approver ownership. |

| Consistency | Same process, every month. |

| Audit Readiness | All checklists and comments stored for compliance. |

Diagram: Automated Month-End Close Workflow

Title: How an Automated Month-End Close Process Works

Conclusion

A fast, accurate, and transparent month-end close isn’t about working harder — it’s about working smarter.

By leveraging automation, finance teams can move from chaos to control, from stress to strategy. The result? A consistent, one-day close that delivers reliable data every month.

Platforms like PivotXL make this transformation easier than ever. With PivotXL, you can automate the entire month-end close — from trial balance imports and reconciliations to report generation and distribution — all within Excel. It turns complex, manual tasks into structured, repeatable workflows that save time and reduce errors.

In short, automation transforms the month-end close from a scramble into a system — one that repeats, improves, and scales effortlessly with the help of modern tools like PivotXL.