📘 This post is part of the ebook: Automating Financial Planning, Reporting & Analysis in Excel

Read the full Table of Contents: Automating Financial Planning, Reporting & Analysis in Excel

⬅️ Previous Chapter: Chapter 9: KPIs and Dashboards — Turning Data into Decisions

Introduction

In today’s fast-moving financial landscape, an Excel FP&A automation system is no longer a luxury — it’s a necessity.

By integrating automation, data, and collaboration, finance teams can transform Excel from a simple spreadsheet tool into a powerful FP&A platform.

Throughout this series, we’ve explored how automation modernizes financial planning and analysis (FP&A).

Now, in this chapter, we bring it all together — showing how you can design your own Excel-centered FP&A automation system that unifies budgeting, forecasting, reporting, and analysis into one intelligent ecosystem.

1. Excel FP&A Automation in Budgeting: From Numbers to Buy-In

Budgeting is more than just entering numbers — it’s about collaboration and ownership.

In traditional Excel workflows, budget files are emailed, edited separately, and manually merged, creating confusion and delays.

However, with an Excel FP&A automation system, this process transforms dramatically:

- Shared, centralized templates connected to the chart of accounts

- Clear preparer–approver workflows

- Comments and explanations tied to each line item

- Structured submission and consolidation timelines

As a result, automation ensures that every department works together in real time. Consequently, budgets become accurate, transparent, and trusted — reflecting the ownership of the people who drive results.

2. Excel FP&A Automation for Financial Reporting: From Trial Balance to Real-Time Statements

Traditional reporting often involves hours of manual consolidation, copy-pasting, and reconciling.

Fortunately, an automated FP&A system in Excel eliminates these inefficiencies.

Here’s what changes once Excel connects to your central database or data warehouse:

- Financial statements (P&L, Balance Sheet, Cash Flow) update automatically

- Account mappings are defined once and reused

- Entity consolidation happens instantly

- Broken links and version errors disappear

Therefore, your month-end close — which once took a week — can now be completed in hours, with real-time accuracy and confidence.

3. Excel FP&A Automation for Analysis: Turning Static Numbers into Dynamic Insights

Once reporting is automated, finance can finally focus on what really matters — insight.

Automation enables Excel templates to automatically calculate key metrics like variance, margin, and KPIs whenever data updates.

Moreover, dynamic dashboards visualize these insights instantly, allowing teams to:

- Detect trends faster

- Understand the “why” behind performance

- Present findings visually to leadership

Ultimately, in an Excel FP&A automation system, finance evolves from being a reporter of the past to a storyteller of the future.

4. Month-End Close in Excel FP&A Automation: From Chaos to Control

Manual month-end close processes are often chaotic — endless reconciliations, missing files, and last-minute surprises.

Thankfully, automation introduces structure and reliability:

- Recurring checklists guide tasks and owners

- Validation rules automatically catch mismatches

- Workflow tracking monitors progress across teams

- Consolidation steps are repeatable and traceable

Consequently, the month-end close becomes a controlled, one-day process — not a weekly scramble.

5. Forecasting & Scenario Planning in Excel FP&A Automation: From Guessing to Adapting

Forecasting no longer needs to be an annual guessing game.

In an Excel FP&A automation system, it becomes continuous and adaptive.

Here’s how automation transforms forecasting:

- Actuals automatically flow in from reporting systems

- Scenario drivers (revenue, costs, demand) update instantly

- Rolling forecasts extend automatically each month

Furthermore, finance teams can test multiple “what-if” scenarios — best, base, and worst cases — and instantly see the impact on profitability, cash flow, and runway.

In short, forecasts become living, evolving models that reflect reality in real time.

6. Excel FP&A Automation Dashboards: From Data to Decisions

Dashboards bring all FP&A layers together.

They visualize company performance, promote alignment, and help everyone understand the story behind the numbers.

Using Excel-based dashboards within your FP&A automation system gives you complete control over calculations and design — while connecting to live data for real-time updates.

Modern dashboards include:

- Automatic data refreshes

- Interactive KPI tracking

- Notes and alerts for context

- Drill-down features for detailed insights

Additionally, when shared via web portals, these dashboards make financial insight accessible company-wide, helping every stakeholder make better, faster decisions.

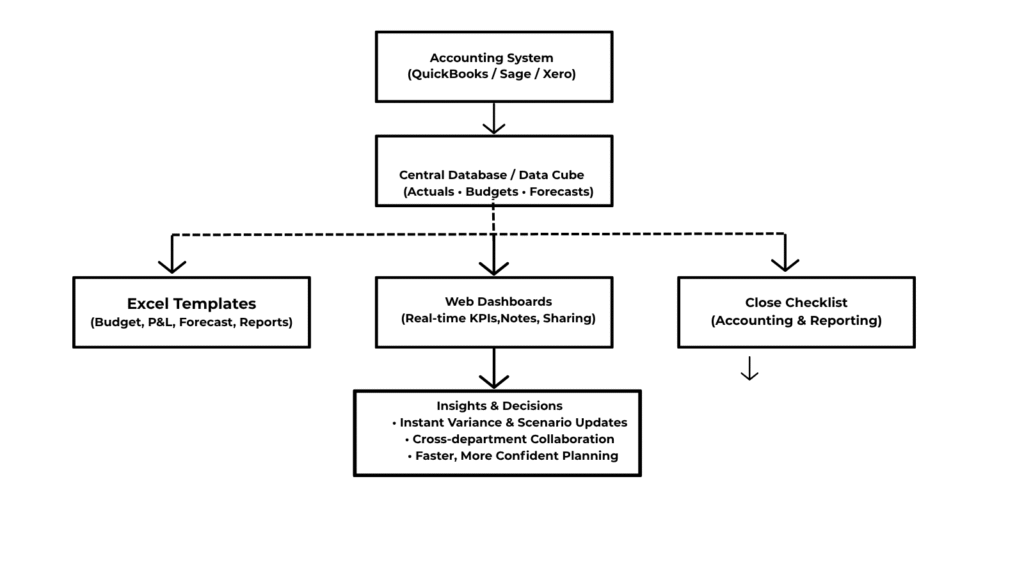

The Unified FP&A Architecture

The Excel FP&A automation system unites budgeting, reporting, forecasting, and dashboards into one cohesive ecosystem.

This modern architecture connects data, people, and processes — making Excel the intelligent front-end of your entire financial planning and analysis system.

This modern architecture connects data, people, and processes — making Excel the intelligent front-end of your entire financial planning and analysis system.

Building Your Own Excel FP&A Automation System

Here’s a step-by-step roadmap to design your own automation environment:

Evolve Continuously: Integrate rolling forecasts, predictive analytics, and AI-driven insights as your system matures.

Centralize Data: Consolidate all actuals, budgets, and forecasts into one source of truth (SQL, Power BI, or OLAP cube).

Standardize Mappings: Define a consistent chart of accounts for all reports and entities.

Automate Templates: Create Excel templates for P&L, Balance Sheet, and Cash Flow that refresh directly from your data source.

Establish Workflows: Build preparer–approver cycles, assign ownership, and set submission timelines.

Visualize and Share: Develop KPI dashboards in Excel and connect them to collaborative web platforms.

The Future of Finance Is Integrated

Automation doesn’t replace finance professionals — it empowers them.

By using Excel as the core of your FP&A system, connected to live data and automated workflows, finance teams can focus on strategy, not spreadsheets.

Moreover, when finance leads automation, the entire organization benefits — through faster insights, better decision-making, and stronger financial control.

Thus, Excel — once seen as a static reporting tool — becomes the dynamic engine driving modern FP&A.

Key Takeaway

Automation in FP&A isn’t just a tech project — it’s a strategic design philosophy.

It’s about creating systems that are:

- Repeatable: Consistent every month

- Collaborative: Connecting teams across departments

- Transparent: Ensuring accuracy and traceability

- Scalable: Growing with your business

With an Excel FP&A automation system, finance evolves from reporting the past to shaping the future.

Conclusion

Bringing it all together, designing your Excel FP&A automation system means rethinking how finance operates.

By unifying budgeting, reporting, forecasting, and analysis into one intelligent framework, you create a finance function that’s faster, smarter, and more connected.

Ultimately, Excel remains the trusted heart of finance — now supercharged by automation and powered by live data.

Platforms like PivotXL make this transformation even easier by connecting Excel to centralized databases, automating workflows, and delivering real-time insights — all without forcing finance teams to leave the tool they know best.

This is the future of financial planning and analysis: a world where finance leads transformation, not paperwork.

With the right platform, such as PivotXL, your Excel-centered FP&A automation system can become the foundation for a truly data-driven, collaborative, and agile finance function.