For most finance teams, Excel is still the go-to tool for preparing financial statements.

It’s flexible, customizable, and instantly familiar. But as your business grows, the manual work behind it—copying trial balances, mapping accounts, updating formulas—becomes a real bottleneck.

That’s where automating financial statements in Excel changes the game.

You get the flexibility of Excel without the tedious manual steps.

👉 Check out our FREE YouTube Course: Automating Trial Balance to Financial Statements in Excel with PivotXL (currently in progress!)

Why Automate Financial Statements in Excel?

- Save Time on Month-End Close

Stop spending hours on copy-paste and formula fixes. With automation, your statements update instantly when new data comes in. - Reduce Errors

Broken links, inconsistent mappings, and manual typos can derail the accuracy of your P&L and balance sheet. Automation ensures consistency across every reporting period. - Enable Faster Decision-Making

When statements are ready in minutes—not days—you can shift focus from preparing reports to analyzing results. - Reuse Mappings and Templates

Map your trial balance once, and use the same template every month or quarter.

The Manual vs. Automated Approach

| Step | Manual in Excel | Automated in Excel |

|---|---|---|

| Import trial balance | Copy-paste from accounting system | Pull directly into a multi-dimensional database |

| Map accounts to statements | SUMIFS / VLOOKUP every month | One-time roll-ups in the cube, reusable for any period |

| Prepare statements | Adjust ranges, fix formulas | Refresh data with a click in Excel |

| Consolidate entities | Merge files manually | Automatic consolidation in the cube |

| Final review | Multiple email iterations | Version-controlled in one file |

Related Read: Mapping Trial Balance to Financial Statements in Excel

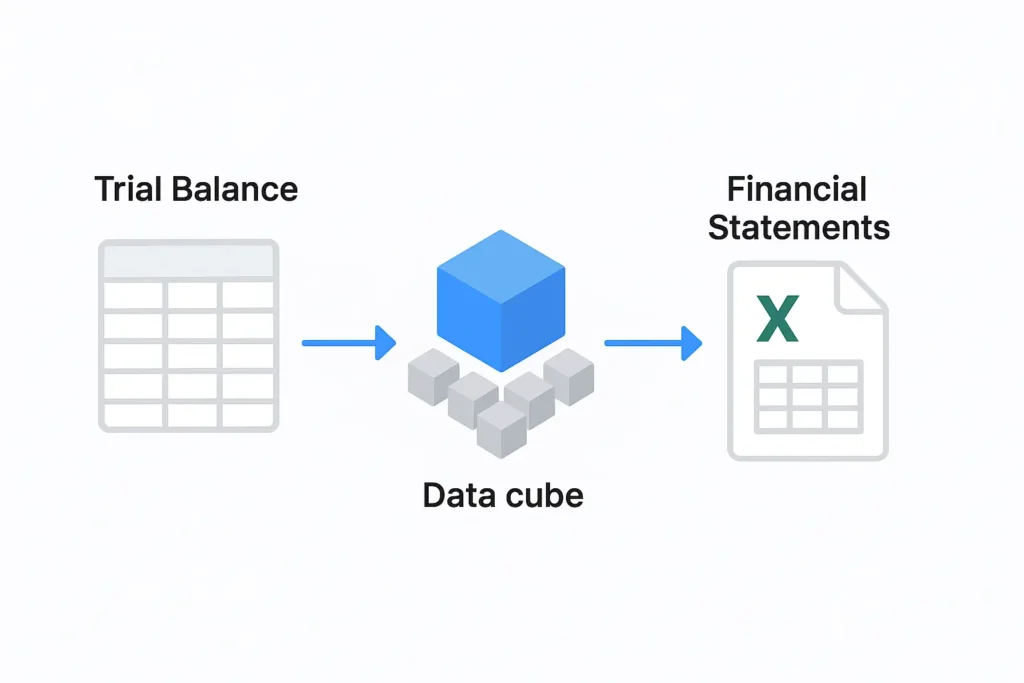

The Automated Approach: Powering Excel with a Multi-Dimensional Database

The most effective way to automate financial statements in Excel isn’t just hooking up a live trial balance feed — it’s storing that data in a multi-dimensional database, also known as a data cube.

Here’s why this matters:

➡ Related Read: Introduction to Data Cubes

1. Set Up Roll-Ups Once and Reuse Them Forever

Instead of writing SUMIFS or VLOOKUP formulas every period, you define account roll-ups directly in the cube (e.g., all revenue accounts → “Revenue” line). Once these roll-ups are set, they apply to any period, entity, or scenario you select.

➡ Related Read: The Role of Roll-Ups and Drill-Downs in MIS Reporting

2. Add Rich Dimensions Beyond the Chart of Accounts

A trial balance only tells part of the story. A multi-dimensional database lets you track and filter by:

- Scenario (Budget, Forecast, Actual, Prior Year)

- Department, Product, or Region

- Time Periods for horizontal analysis (e.g., month-over-month or year-over-year changes)

3. Instantly Switch Between Views

Because the data is structured in dimensions, you can pivot between:

- Consolidated company view

- Individual department or entity view

- Budget vs. Actuals

- Multi-year trend analysis

4. Excel as the Front-End

With a tool like PivotXL, Excel becomes the reporting canvas while the heavy lifting happens in the database:

- Data loads automatically from your accounting system

- Roll-ups and mappings live centrally in the cube

- Reports refresh with a click — no broken formulas, no manual consolidation

➡ Related Read: Why Data Cubes Matter in 2025

💡 Example:

Want to see your income statement for Q2 Actuals vs. Budget, with a year-over-year column for each line item?

In a traditional Excel setup, that’s multiple worksheets, complex formulas, and a lot of risk.

In a cube-powered model, it’s just:

- Select

Scenario = Actual, Budget - Select

Time = Q2 2025, Q2 2024 - Refresh

Final Thoughts

Automating financial statements in Excel doesn’t mean replacing Excel—it means supercharging it.

With the right setup, you’ll:

- Close faster

- Reduce errors

- Spend more time on analysis, not admin work

Related Read: How to Prepare Financial Statements from Trial Balance in Excel