The business budgeting software market has expanded at a remarkable pace, with more than 150 vendors now offering solutions in 2026. However, not all budgeting tools are created equal—especially when it comes to how they interact with Excel, the tool finance teams have relied on for decades.

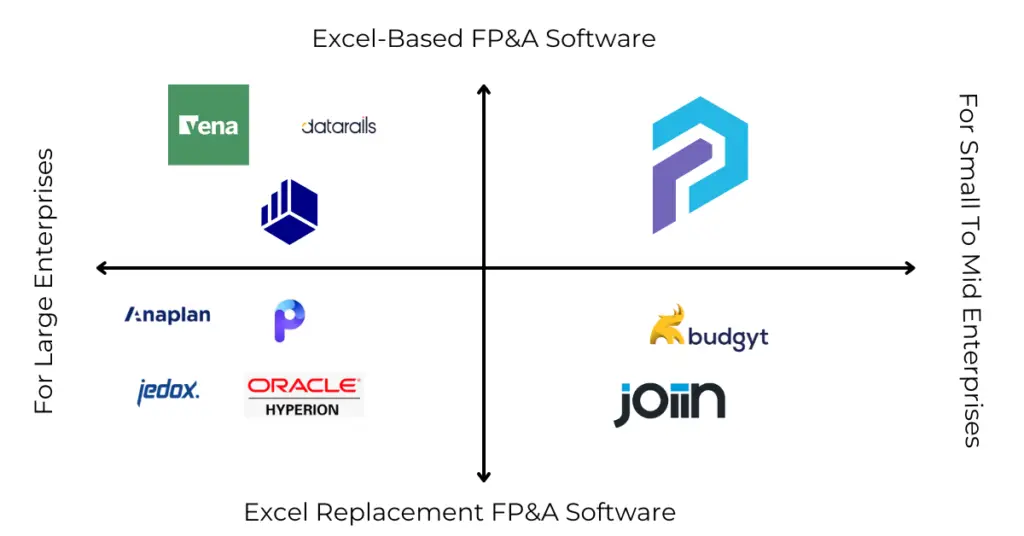

Some modern platforms position themselves as Excel replacements, requiring users to learn entirely new interfaces and workflows. While these tools can bring structure, they often create friction by forcing finance teams away from the familiarity of spreadsheets. Other platforms take a different approach, choosing to embrace Excel as the front-end calculation and reporting layer. This model allows finance professionals to continue working in the environment they know best, while still benefiting from the automation, centralization, and scalability of budgeting software running in the background.

💡 Looking for a detailed guide on Automating Excel-based budgeting processes? Check out our step-by-step article .

💡Generally, budgeting software and FP&A software have very similar functionality, and while they often overlap, each has its own focus depending on how finance teams use it. Read our full guide here on Excel Based FP&A software

Why Use Excel-Based Budgeting Software?

1) Familiarity with Excel Reports

Management and stakeholders are already comfortable receiving reports in Excel. Excel-based budgeting tools let finance teams prepare budgets, forecasts, and variance analyses in the same format they use every day.

2) Drill-Down Capabilities

Budget vs. actuals reviews often require going beyond summaries. Excel-compatible systems allow drill-down from any budget line to transactions, departments, or accounts.

3) Ease of Custom Calculations

Every business has unique metrics—cash flow drivers, headcount plans, product-level forecasts. Excel’s flexibility makes it the ideal calculation layer, while the budgeting software handles storage and version control.

4) Integration with PowerPoint

Budgets usually end up in board decks. With Excel-linked charts and graphs, finance teams can update slides automatically as assumptions or numbers change.

The State of Budgeting Software in 2026

Over the past five years, budgeting and FP&A software has attracted hundreds of millions in funding. But in 2026, the market looks different:

- Several well-funded startups shut down or were acquired due to lack of growth capital.

- Customers now face vendor risk when selecting tools, making it critical to choose providers with sustainable models.

- Excel-compatible solutions have remained resilient, since finance teams still rely on spreadsheets for speed and flexibility.

Excel-Based Budgeting Software Pricing

With over 150 vendors, pricing models vary widely:

- Most budgeting platforms cost $2,000-10,000+ per month.

- Enterprise contracts can reach six figures annually.

- PivotXL stands out as a disruptor—pricing starts at $100 – $2000 per month, making it accessible for SMEs and fractional CFO firms.

Top Vendors: Best Excel-Compatible Budgeting Software in 2026

1. PivotXL

- Strengths: Powerful Excel add-in for mapping trial balances, managing input templates, and synchronizing budget data. Includes roll-ups, variance analysis, and scenario modeling.

- Pricing: Starting at $100/month – $2000/month, affordable for SMEs and finance consultants.

- Differentiator: Custom scripts for automating forecasts, allocations, and KPI calculations.

- Extra: Offers dedicated analyst support for continuous help.

👉 Try PivotXL free today.

2. Cube FP&A

- Strengths: Provides an Excel add-in for budgeting and forecasting. Focused on mid-market U.S. companies.

- Pricing: Starts at $2,000/month, less accessible for small teams.

- Challenge: As a VC-backed startup, Cube faces pressure to scale pricing.

👉 Cube vs. PivotXL: full comparison.

3. DataRails

- Strengths: Transitioned from a data-management platform to a budgeting and FP&A tool. Strong growth after raising venture funding.

- Pricing: Typically $2,000+/month.

- Challenge: May pass investor-driven cost pressures to customers.

👉 DataRails vs. PivotXL: full comparison.

4. Vena Solutions

- Strengths: One of the earliest Excel-based budgeting software providers, with a strong enterprise client base.

- Pricing: Contracts average $30,000+ per year, positioning it as the most expensive option.

- Positioning: Suited for large enterprises with complex budgeting needs.

👉 Vena vs. PivotXL: full comparison.

Excel-Based or Excel-Replacement in 2026?

When evaluating budgeting tools, ask whether they are:

- Excel-based → Keep Excel as the interface, reducing learning curves.

- Excel-replacement → Force finance teams into new reporting tools, often leading to adoption challenges.

For most finance teams, Excel-based solutions strike the right balance between control and automation.

Conclusion

For SMEs and mid sized businesses, PivotXL offers the most compelling option—cost-effective, Excel-friendly, and supported by dedicated analysts. Larger enterprises with billion-dollar revenues may prefer DataRails or Vena Solutions for their enterprise-scale needs.

The right budgeting software depends on your company’s size, budget, and complexity. But one thing is clear: in 2026, Excel-based solutions remain the most flexible and future-proof choice for business budgeting.