📘 This post is part of the ebook: Automating Financial Planning, Reporting & Analysis in Excel

Read the full Table of Contents: Automating Financial Planning, Reporting & Analysis in Excel

⬅️ Previous Chapter: Chapter 3: From Spreadsheets to Systems — Building a Centralized Financial Architecture

➡️ Next Chapter: Chapter 5: Automating Financial Reporting in Excel

Introduction:

Collaborative Budgeting Automation in FP&A not only improves efficiency but also aligns financial goals across teams.

Traditional budgeting methods—filled with Excel chaos, version errors, and endless email threads—are being replaced by connected, automated workflows that foster transparency and buy-in.

In this chapter, we’ll explore how Collaborative Budgeting Automation in FP&A enhances budgeting accuracy, reduces manual effort, and turns financial plans into collaborative commitments.

Collaborative Budgeting Automation as the Foundation of FP&A

Every financial plan begins with a budget — the organization’s map for achieving its strategic goals.

Most teams forecast income and expenses across a chart of accounts, rolling them into a forward-looking Profit & Loss statement.

Yet, while calculations are simple, aligning decision-makers behind those numbers is where true FP&A success happens.

Why Budgeting Matters

A budget isn’t just a spreadsheet — it’s a commitment mechanism.

It ensures that everyone, from executives to department heads, aligns on what’s achievable.

The budgeting process helps:

- Clarify assumptions and constraints

- Align departments with company objectives

- Provide benchmarks for variance analysis

- Drive accountability across the organization

Without stakeholder buy-in, even the best models remain theoretical.

Top-Down vs Bottom-Up Budgeting

| Approach | Description | Strength | Weakness |

|---|---|---|---|

| Top-Down | Management defines revenue and margin targets based on strategic goals. | Fast and high-level strategic alignment. | Can miss operational realities. |

| Bottom-Up | Department heads build budgets from operational data. | High accuracy and ownership. | Slower and harder to consolidate. |

The sweet spot lies in a collaborative blend — finance defines the framework, while departments contribute realistic plans.

Budgeting is no longer just calculation — it’s conversation.

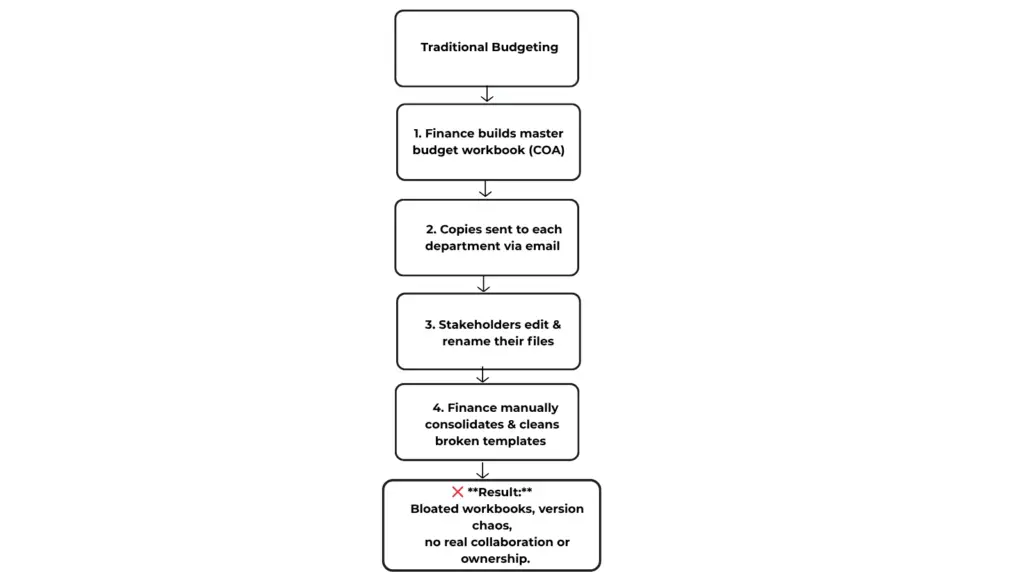

The Reality of Manual Budgeting

Traditional budgeting in Excel usually follows two painful paths:

- The “Franken-Workbook”

A massive, interconnected Excel file where one broken formula can destroy hours of work. It’s fragile, hard to update, and nearly impossible for multiple users to edit at once. - The “Email Round-Robin”

Separate templates are sent to different departments. Each version comes back altered, and finance spends days reconciling mismatched data before analysis even begins.

Both are time-consuming, error-prone, and create bottlenecks.

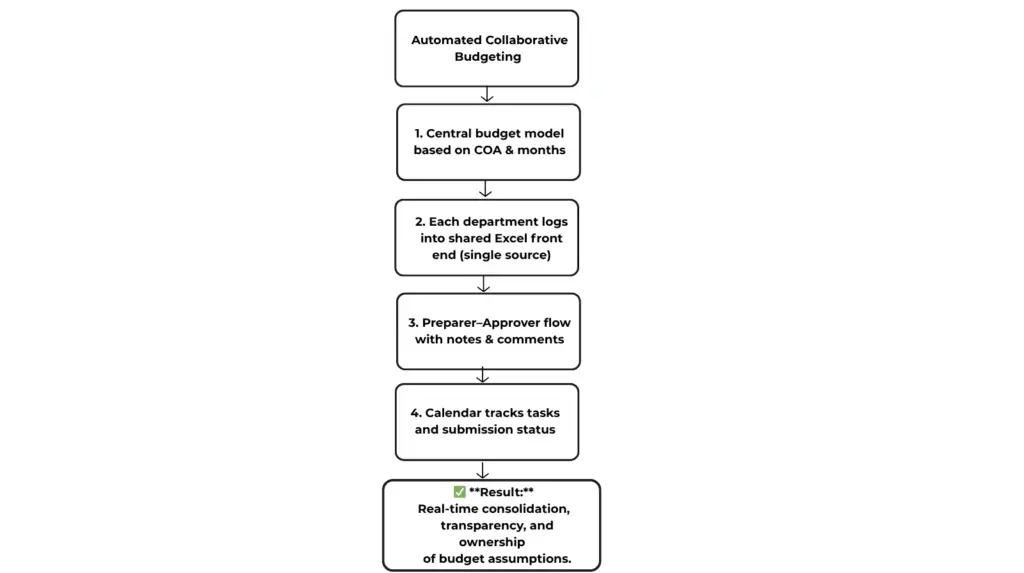

The Automated Way: Collaborative Budgeting Automation in FP&A

Automation brings structure, visibility, and accountability.

Here’s what a modern, collaborative budgeting system looks like:

- Central Template Control – Finance manages a standardized budget model linked to the company’s COA.

- Preparer–Approver Workflow – Each budget line has clear ownership, review, and approval rights.

- Context & Notes – Add comments, assumptions, and business reasoning directly to each line item.

- Calendar & Deadlines – Track submissions, bottlenecks, and reminders automatically.

- Real-Time Consolidation – All submissions instantly roll up into the master P&L — no more version confusion.

Diagram: How Budgeting Evolves — From Spreadsheets to Collaboration

Traditional Budgeting :

Automated Budgeting :

The Value of Collaborative Budgeting Automation

When stakeholders build their own budgets, they own the numbers.

That ownership leads to accountability, and accountability drives better business outcomes.

Collaborative budgeting ensures:

- Every department understands why the numbers exist

- Finance becomes a partner, not a gatekeeper

- Conversations replace confusion

Automation doesn’t remove people — it empowers them to work smarter and faster.

Key Takeaway

Budgeting isn’t just about forecasting profit — it’s about creating shared ownership.

When automation supports collaboration, the budget transforms from a spreadsheet into a living plan that reflects real-world accountability and shared goals.\

Conclusion

The budgeting process is evolving — from static Excel sheets to interactive, automated platforms that drive engagement and trust.

By combining finance automation tools with collaborative workflows, organizations move from “numbers on a page” to buy-in across teams.

💬 In the next chapter, we’ll explore Automating Financial Reporting, where we connect budgets to real-time performance dashboards for continuous improvement.