Why Excel Still Rules FP&A

For finance teams, Excel isn’t just a tool — it’s the universal language of accounting and analysis.

From ad‑hoc calculations to complex scenario modeling, Excel remains the calculation engine of choice.

But as companies scale, managing budgeting, forecasting, and reporting in disconnected spreadsheets turns into chaos — broken links, manual roll‑ups, and version sprawl.

That’s where Excel-based FP&A software comes in. Instead of replacing Excel, these tools connect Excel to a centralized database, task management, and automation features — giving you structure and speed without sacrificing the spreadsheet flexibility you rely on.

What Is FP&A Software?

FP&A (Financial Planning & Analysis) covers three core processes:

- Budgeting – Setting financial targets and allocating resources

- Forecasting – Projecting revenue, expenses, and cash flow

- Reporting – Turning data into insights for management and boards

Excel-based FP&A software sits between pure spreadsheets and “Excel-replacement” platforms.

✅ You keep Excel as your calculation engine.

✅ You add automation, roll-ups, and collaboration.

✅ You eliminate version chaos, broken formulas, and manual consolidation.

📌 FP&A Software vs. Financial Reporting Software – What’s the Difference?

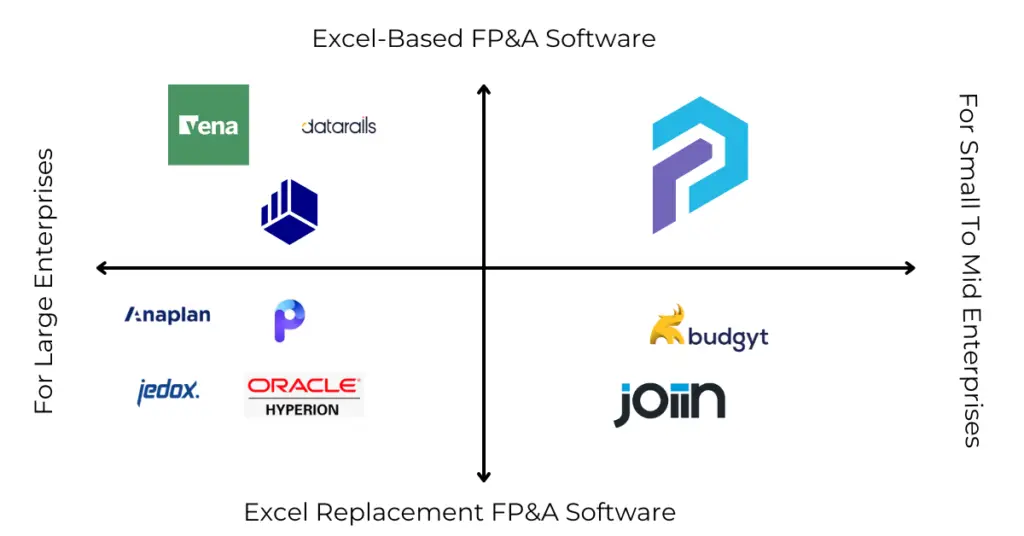

Excel-Based vs. Excel-Replacement FP&A Tools

Not all FP&A software treats Excel equally.

- Excel-Based FP&A Software – tools like PivotXL, Datarails, and Vena integrate with Excel. Finance teams keep using spreadsheets for modeling while the software manages data, workflow, and consolidation in the background.

- Excel-Replacement Tools – platforms like Anaplan or Workday Adaptive replace Excel with web-only interfaces. These can offer control but force teams to abandon their spreadsheets entirely.

📌 Excel-Based vs. Excel-Replacement FP&A Tools – Which Is Right for You?

Key Features of Excel-Based FP&A Software

What makes Excel-based FP&A software powerful isn’t just the link to spreadsheets — it’s the structure behind it.

✅ Centralized Database – One source of truth for actuals, budgets, and forecasts.

✅ Excel Add‑In – Pull and push data directly from Excel without copy‑pasting.

✅ Automated Roll‑Ups – Instantly consolidate data across entities, scenarios, and departments.

✅ Task Management – Assign, track, and approve inputs without endless email chains.

✅ Custom Scripts – Automate allocations, calculations, and advanced modeling logic.

How FP&A Teams Use Excel-Based Software

1. Budgeting

Finance sends department heads Excel templates, they fill in numbers, and the data syncs back automatically. No broken links, no manual consolidation.

📌 Budgeting in Excel – Manual vs. Automated

2. Forecasting

Different accounts get forecasted differently: some need stakeholder inputs, others rely on assumptions like rolling averages or growth rates. The system consolidates them into a forward-looking P&L.

📌 Forecasting in Excel – Simplified with PivotXL

3. Reporting

Live actuals, budgets, and forecasts roll up into dashboards and reports — all still accessible in Excel.

📌 Financial Reporting in Excel – Best Practices

Who Benefits from Excel-Based FP&A Software?

- Lean finance teams that can’t afford a dedicated FP&A headcount but need automation.

- Scaling companies moving beyond manual spreadsheets but not ready to abandon Excel.

- Multi-entity or multi-location organizations needing roll-ups and consolidations.

📌 When to Move from Pure Excel to Excel-Based FP&A Software

Top Excel-Based FP&A Vendors

📌 4 Best Excel-Based FP&A Software (2025)

- PivotXL – Excel-first, affordable, with custom scripting and back-office analyst support.

- Cube – Strong Excel/Google Sheets connector for mid-market finance teams.

- Vena – Enterprise Excel interface with a higher price and heavier implementation.

- Datarails – Reporting automation for smaller finance teams, Excel-centric.

Why Excel-Based FP&A Software Beats Going Full “No-Excel”

- Keeps your existing Excel models alive (no need to rebuild everything in a new UI).

- Faster adoption — teams already know Excel, so no heavy retraining.

- Lower cost & complexity — easier to implement than big-box FP&A systems.

📌 Excel Models vs. Web-Only FP&A Models – What Finance Teams Prefer

Conclusion: The Best of Both Worlds

Excel isn’t going anywhere — it’s still the fastest, most flexible tool for finance.

Excel-based FP&A software doesn’t replace Excel. It supercharges it.

By combining the modeling power of spreadsheets with the structure of a database, automated roll-ups, and task management, companies streamline budgeting, forecasting, and reporting without losing the flexibility finance teams depend on.