Master Excel FV / PV Skill Practice – Practice Problems Excel Free Download

If you want to strengthen your Excel skills, this guide provides practice problems Excel free download to master FV and PV functions. Understanding these functions is essential in finance, as the time value of money (TVM) shows that a dollar today is worth more than a dollar tomorrow because it can be invested and earn interest.

Two fundamental Excel functions that bring this principle to life are:

- FV (Future Value) – to calculate the value of an investment or savings at a future date.

- PV (Present Value) – to calculate how much a future sum of money is worth today.

This guide is a complete Excel FV / PV skill practice resource with formulas, step-by-step instructions, and 20 fully solved problems. By the end, you’ll have the confidence to use FV and PV in real-world scenarios such as investment planning, loan calculations, retirement forecasting, and business decision-making.

Explore More Excel Functions

Want to master all essential Excel formulas in one place?

Check out our complete guide —

👉 Mastering Excel Formulas: Free Excel Practice Problems for Accounting and Finance

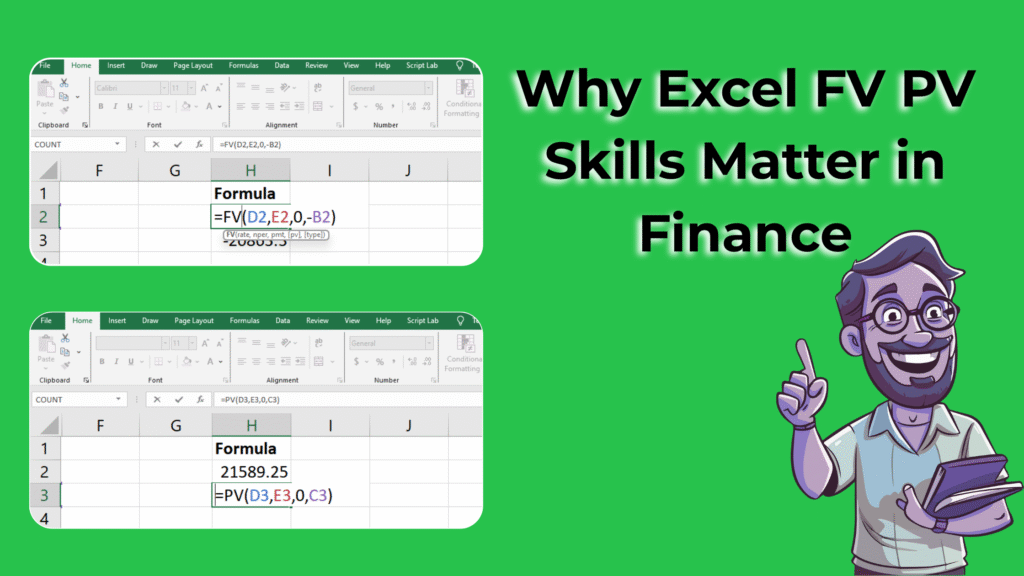

Why Excel FV PV Skills Matter – Free Excel Practice Problems

- Investment Analysis: Helps you estimate how much today’s money grows over time.

- Loan Planning: Allows you to calculate the present cost of future loan repayments.

- Retirement Planning: Tells you how much you need to save today for your future goals.

- Business Valuation: Critical in calculating discounted cash flows and project worth.

If you want to build strong finance skills in Excel, FV and PV are must-learn functions.

Excel FV and PV Functions – Practice Problems Included

1. Future Value (FV) – Practice Problem Examples

The FV function estimates the value of an investment in the future, considering interest, periods, and payments.

Formula:

=FV(rate, nper, pmt, pv, type)

- rate → Interest rate per period

- nper → Total number of periods

- pmt → Payment made each period (use negative value for outflow)

- pv → Present value (initial amount)

- type → 0 (end of period, default) or 1 (start of period)

Example:

If you invest $5,000 today for 5 years at 8% annually:

=FV(8%,5,0,-5000)

Result = $7,346

2. Present Value (PV) – Practice Problem Examples

The PV function discounts a future amount back to today’s value using interest and time.

Formula:

=PV(rate, nper, pmt, fv, type)

- rate → Interest rate per period

- nper → Total number of periods

- pmt → Recurring payments (if any)

- fv → Future value (goal)

- type → 0 (end of period) or 1 (start of period)

Example:

What is the PV of $50,000 due in 10 years at 6% annual interest?

=PV(6%,10,0,-50000)

Result = $27,919

Practical Applications of FV and PV – Free Practice

- Retirement Savings Planning

- Calculate how much your contributions will grow in 30 years.

- Loan and Mortgage Analysis

- Find the present value of loan repayments or future installments.

- Investment Comparisons

- Compare lump-sum vs recurring payments.

- Education Fund Forecasting

- Estimate how much money you’ll need to invest today for future tuition fees.

- Corporate Finance Decisions

- Discount future project cash flows to assess net worth.

Excel FV PV Practice Dataset for Download

Here’s a sample dataset you can use in Excel to practice:

Example Dataset (structured in Excel)

| Case | PV | FV Target | Rate | Years |

|---|---|---|---|---|

| A | 10000 | 8% | 10 | |

| B | 50000 | 6% | 15 | |

| C | 5000 | 10% | 5 | |

| D | 20000 | 7% | 20 | |

| E | 100000 | 9% | 25 |

B = PVC = FV TargetD = RateE = Years

So Case A row is B2:E2, Case B is B3:E3, and so on.

20 FV / PV Skill Practice Problems with Answers

- Future Value of Case A

=FV(D2, E2, 0, -B2)→ 21,589.25 - Present Value required for Case B

=PV(D3, E3, 0, C3)→ 20,717.44 - Future Value of Case C

=FV(D4, E4, 0, -B4)→ 8,052.55 - Present Value required for Case D (FV=50,000)

=PV(D5, E5, 0, 50000)→ 12,897.96 - Future Value of Case E

=FV(D6, E6, 0, -C6)→ 862,308.29 - Compare FV with doubled years (Case A)

=FV(D2, E2*2, 0, -B2)→ 46,610.57 - FV if rate is halved (Case C)

=FV(D4/2, E4, 0, -B4)→ 6,381.41 - PV for reaching FV=75,000 in Case D’s conditions

=PV(D5, E5, 0, 75000)→ 19,346.94 - FV for Case A with quarterly compounding

=FV(D2/4, E2*4, 0, -B2)→ 22,080.40 - PV for Case E with semiannual compounding

=PV(D6/2, E6*2, 0, C6)→ 7,586.79 - FV of Case B with 10 years instead of 15

=FV(D3, 10, 0, -PV(D3, 15, 0, C3))→ 35,743.49 - PV of Case C for FV=20,000

=PV(D4, E4, 0, 20000)→ 12,429.22 - FV of Case D with additional 5 years

=FV(D5, E5+5, 0, -B5)→ 81,104.17 - PV of Case A with target FV=50,000

=PV(D2, E2, 0, 50000)→ 23,172.49 - FV of Case C with annual deposits of 1,000

=FV(D4, E4, -1000, -B4)→ 14,207.49 - PV of Case E for FV=200,000

=PV(D6, E6, 0, 200000)→ 23,202.64 - FV of Case B if rate increases by 2%

=FV(D3+2%, E3, 0, -PV(D3, E3, 0, C3))→ 71,791.68 - PV of Case D with FV=150,000

=PV(D5, E5, 0, 150000)→ 38,693.88 - FV of Case A with an extra 500 deposit each year

=FV(D2, E2, -500, -B2)→ 29,725.50 - Compare FV for Case C with annual vs. monthly compounding

Monthly:=FV(D4/12, E4*12, 0, -B4)→ 8,235.05

Annual:=FV(D4, E4, 0, -B4)→ 8,052.55

Excel FV PV Practice Template: What You’ll Learn

This Excel FV / PV skill practice template will help you:

- Calculate FV and PV for lump sums and annuities.

- Compare investments with different compounding frequencies.

- Handle monthly, quarterly, and annual cash flows.

- Perform scenario-based analysis (e.g., retirement, loans, business projects).

- Strengthen Excel finance skills with real-world data.

Next Step: Automate It with PivotXL – For Large Excel Practice Problems

While Excel FV and PV functions are powerful, applying them across large datasets can be tedious.

That’s where PivotXL helps:

- Automates cash flow forecasting

- Performs scenario analysis in seconds

- Builds dynamic financial models without manual formula adjustments

This ensures your financial reports are always accurate, updated, and scalable.

Conclusion

The FV and PV Excel functions are essential for anyone in finance, accounting, or business strategy. By practicing with the 20 problems in this guide, you’ll gain real confidence in handling investment planning, loan calculations, and financial decision-making.

To dive deeper, check Investopedia’s guide: Future Value & Present Value Explained