FP&A software for senior living is essential for CFOs at organizations with $50M–$500M in revenue. Finance isn’t just about numbers — it’s about managing the intersection of care, community, and cost.

You’re juggling multiple challenges at once:

- Occupancy rates that directly drive revenue and profitability.

- Multi-location operations with different services, staffing models, and reporting structures.

- CapEx planning for facility renovations, new wings, and equipment upgrades.

- Regulatory reporting that must be accurate, transparent, and audit-ready.

- Board and investor expectations for real-time profitability insights.

At this level of complexity, Excel alone becomes fragile, risky, and inefficient. What once worked for a few facilities and a small finance team quickly turns into a barrier to growth and compliance.

This is why FP&A software for senior living has shifted from a “nice-to-have” to a strategic necessity.

Excel Overload in Senior Living Finance

Excel has been the default finance tool in senior living for decades. It’s flexible, familiar, and powerful. Finance leaders trust it for:

- Tracking occupancy across multiple facilities.

- Building CapEx and renovation plans.

- Forecasting staffing and service costs.

- Preparing board reports and compliance schedules.

But at $50M–$500M in scale, Excel starts to crack under the pressure:

- Facility-by-Facility Chaos: Each community maintains its own workbook; finance spends weeks consolidating.

- Broken Links: Rename a sheet or move a file and your occupancy calculations no longer reconcile.

- Version Confusion: Multiple “final” spreadsheets circulate, but no one’s sure which is correct.

- Manual Consolidation: Teams burn days merging data across facilities, regions, and service lines.

Excel works — but it doesn’t scale. For senior living CFOs, that makes it a liability for compliance, speed, and accuracy.

How FP&A Software Helps Senior Living CFOs

FP&A software for senior living replaces spreadsheet chaos with structure, automation, and insight.

Here’s how it transforms finance operations:

- Centralized Data Hub: Occupancy, revenue, expenses, and staffing flow into one trusted database.

- Automated Consolidations: Facility-level P&Ls roll up into portfolio-wide reporting instantly.

- Scenario Planning: Model how changes in occupancy, service pricing, or CapEx projects impact cash flow and margins.

- CapEx Tracking: Link renovation and upgrade budgets directly into forecasts.

- Regulatory Reporting: Generate clean, audit-ready reports at the click of a button.

Instead of fighting with spreadsheets, your team can focus on strategy and growth.

Why PivotXL is Unique — FP&A Software That Lets You Stay in Excel

Most FP&A software forces finance teams into rigid, web-based tools that replace Excel. The problem? Your team loses flexibility, familiarity, and control.

PivotXL takes a different approach.

We believe Excel isn’t the problem. The real issue is the lack of structure around Excel.

Senior living CFOs depend on Excel because:

- It’s flexible — you can model occupancy rates, staffing costs, and CapEx however you need.

- It’s familiar — your finance team already knows the templates inside out.

- It’s powerful — nothing beats Excel for quick pivots and deep analysis.

But Excel alone can’t scale. That’s where PivotXL steps in:

- A Central Database: Every facility’s occupancy, expense, and CapEx data flows into one source of truth.

- Deep Excel Integration: Your templates stay the same — refresh with a single click.

- Custom Scripting: Automate occupancy-driven revenue models, expense allocations, and compliance reporting.

- Back-Office Analyst Support: Our analysts extend your team by setting up templates, maintaining mappings, and automating processes.

The result: You stay in your Excel comfort zone — but now it’s organized, automated, and regulator-ready.

Why This Matters for Senior Living CFOs

Senior living finance is unlike any other sector. CFOs face unique challenges that require precision and agility:

- Occupancy changes daily — and must feed directly into revenue models.

- Facilities differ in services, staffing, and CapEx needs — making consolidation complex.

- Boards and investors want timely insights into margins and profitability.

- Regulators demand accuracy in compliance and audit reports.

With PivotXL, CFOs can:

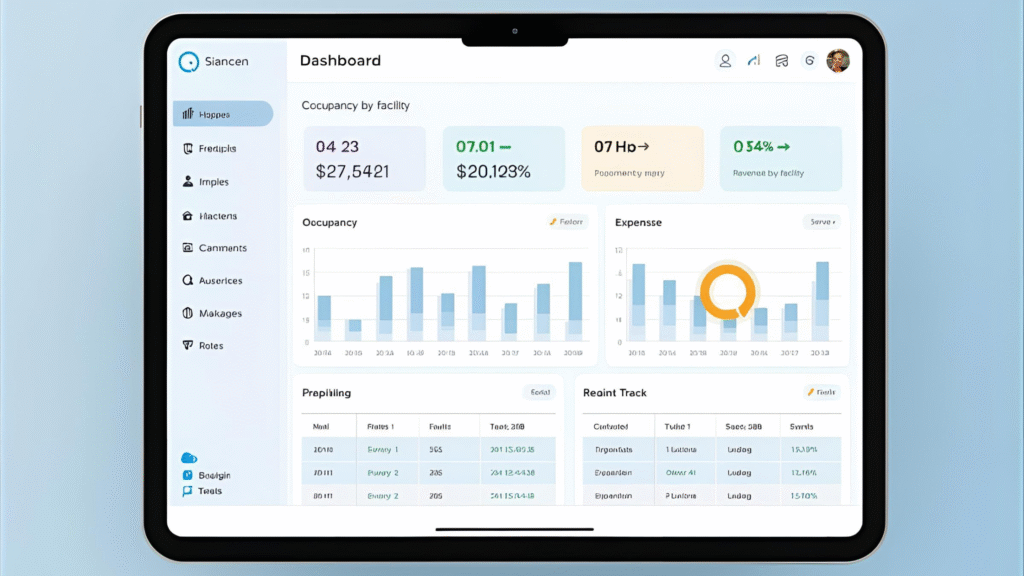

- Generate facility-level P&Ls and occupancy dashboards instantly.

- Tie CapEx projects directly to cash flow forecasts.

- Model occupancy dips, rate adjustments, or staffing shifts in minutes.

- Deliver accurate, real-time board and compliance reporting.

Instead of firefighting in Excel, your finance team can focus on residents, strategy, and growth.

Real-World Examples of FP&A in Senior Living

To illustrate how FP&A software transforms finance operations, let’s look at three examples:

- Occupancy Rate Scenario Planning

A senior living group sees occupancy dip by 3% across facilities. With FP&A software, the CFO models the impact on cash flow, margins, and staffing within minutes — and develops an action plan before the next board meeting. - CapEx Renovation Project Tracking

A facility begins a $10M renovation. Instead of manually updating multiple spreadsheets, FP&A software ties costs directly to forecasts, showing the impact on liquidity and debt coverage in real time. - Multi-Facility Consolidation

A CFO overseeing 15 facilities no longer waits weeks for manual roll-ups. With FP&A software, facility-level reports flow automatically into consolidated dashboards — improving visibility and decision-making.

The Bottom Line

FP&A software for senior living isn’t about replacing Excel.

It’s about making Excel work at scale — with automation, structure, and insights tailored to the unique needs of senior living finance.

PivotXL delivers:

- A centralized database for all your facilities

- Deep Excel integration that keeps your templates intact

- Custom scripting for occupancy, CapEx, and compliance models

- Back-office analyst support that extends your team

For senior living CFOs at $50M–$500M organizations, that means:

- Cleaner, faster reporting

- Sharper forecasting

- Regulatory confidence

- And more time to focus on strategy and resident care

Book a demo today or visit PivotXL.com to see how FP&A software can transform your senior living finance operations.