INTRODUCTION

In the world of finance, Excel has long been the workhorse for many professionals.

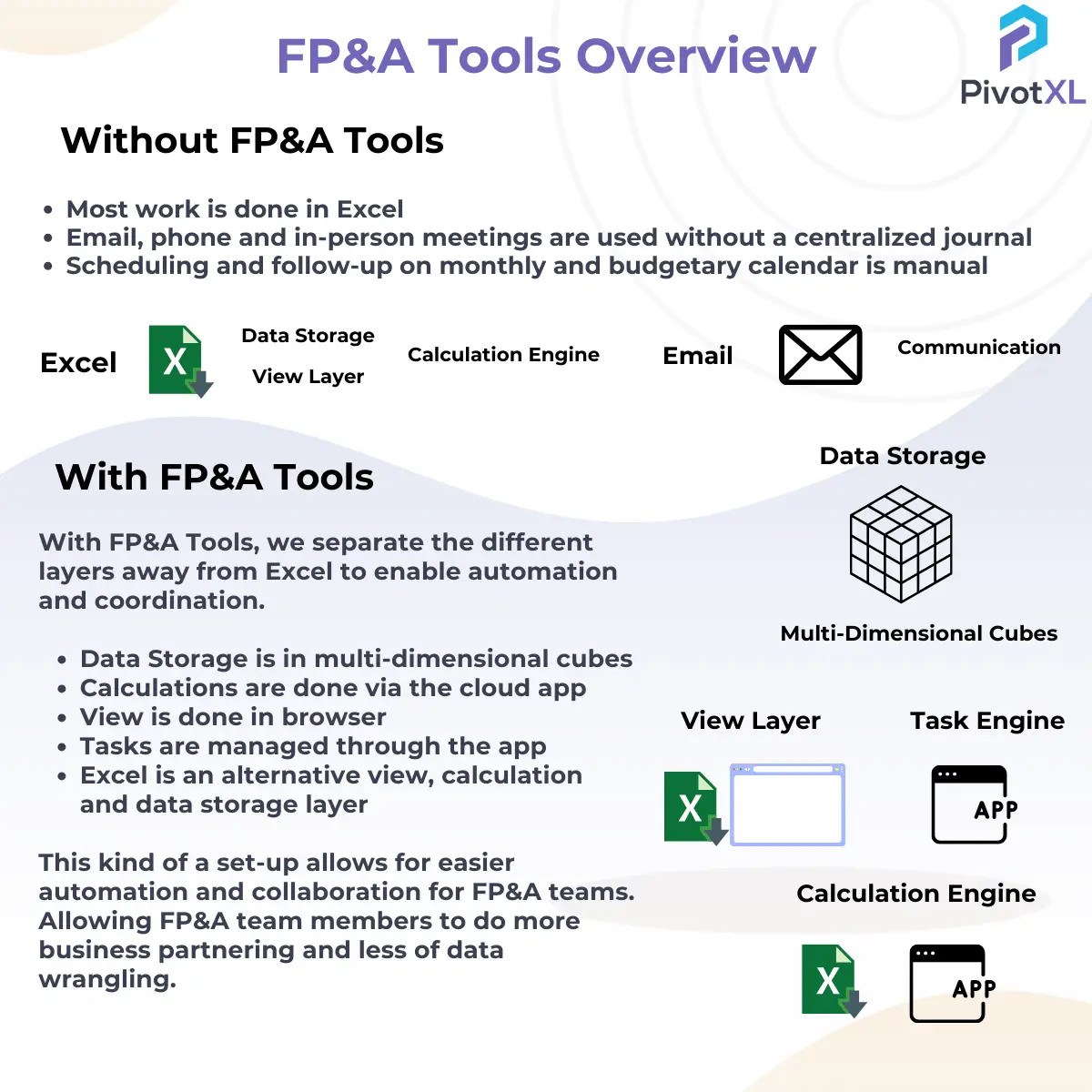

It serves as a data storage, viewing layer, and calculation engine, facilitating numerous financial tasks. However, as businesses evolve and the need for more efficient and

collaborative financial planning and analysis (FP&A) processes becomes evident, FP&A tools have emerged as game-changers.

PROBLEMS WITH EXCEL

Without FP&A tools, most of the work is done in Excel.

Data is stored in countless spreadsheets, communication mainly takes place through emails or phone calls, and consolidating or breaking down data from various sources can be a cumbersome process.

The limitations of Excel become increasingly evident as your FP&A requirements grow, often resulting in a tedious and error-prone process.

HOW ARE FP&A TOOLS ORGANIZED?

Data Storage: Multi-Dimensional Cubes:

FP&A tools leverage multi-dimensional cubes for data storage. This means that you can organize your financial data in a structured and hierarchical manner, making it easier to analyze and report. These cubes allow you to view your data from different angles, helping you gain a deeper understanding of your company’s financial performance.

Pre-Programmed Web Dashboards:

The days of opening multiple Excel files and manually linking them are over. FP&A tools provide a user-friendly, browser based interface for data visualization.

This allows you to create interactive and dynamic reports and dashboards that are easily accessible to relevant team members. These dashboards are shared with relevant people to obtain insights into data discrepancies.

Cloud-Powered Calculations:

With FP&A tools, cloud-based applications handle the heavy lifting. This not only accelerates the calculation process but also ensures accuracy and consistency across the board. Complex financial modeling and scenario planning become more accessible with these tools.

Tasks as a Replacement for Email:

FP&A tools streamline task management within the same application. You can assign, track, and monitor the progress of various tasks and projects. This level of coordination ensures that everyone is on the same page, reducing miscommunication and improving efficiency.

EXCEL AS AN ALTERNATIVE LAYER

FP&A tools don’t replace Excel but enhance it. They automate data, saving time for valuable work. This modern setup fosters collaboration, empowering FP&A teams for strategic financial planning. With multi-dimensional cubes, cloud-powered calculations, and integrated task management, decisions are quick and informed.

In summary, FP&A tool transform finance by streamlining data, enhancing efficiency, and enabling strategic partnering. It’s time to explore this financial game-changer for your success.